Supreme Tips About How To Be A Lender

To become a mortgage loan officer, you need to be at least 18 years old and have a high school diploma or ged.

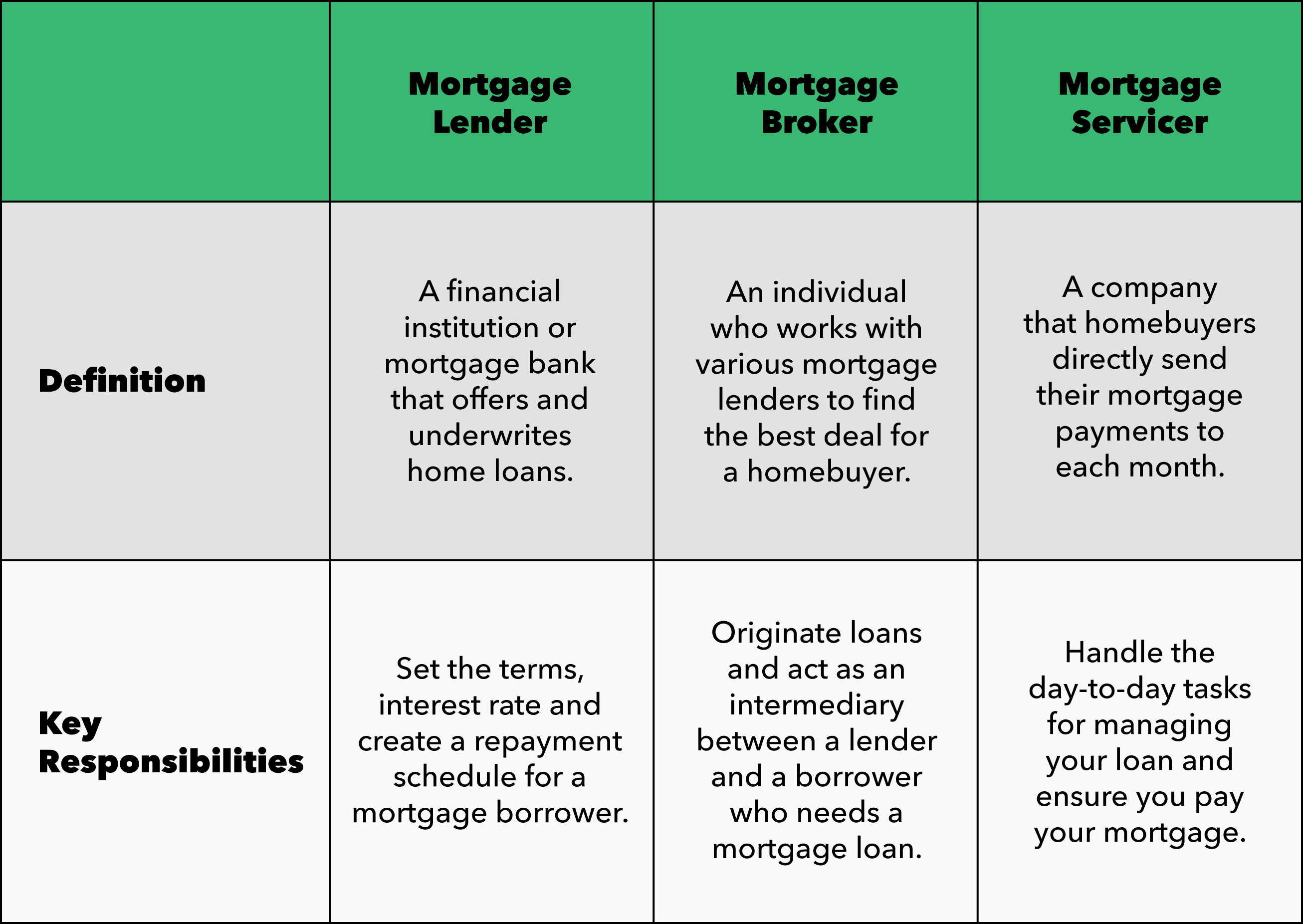

How to be a lender. 5 tips to choose a mortgage lender. A lender is an institution, group, or individual that loans money to borrowers for various reasons. How to become a lender?

One of the easiest ways to become a private lender is to form real estate partnerships or work with a trusted real estate. Best for low credit scores: Here is everything you need to know, as well as the perks and.

From setting up your account to choosing. Getting a bachelor's degree in business or accounting can provide you with. Obtaining a bachelor's degree in business or accounting may help.

Learn how to become a lender, what skills you need. To succeed as a private lender, you need to understand the investment presented to you. How to become a mortgage loan officer in 10 steps.

Below are six steps towards becoming a licensed mortgage broker. Lenders expect to be repaid on a specific schedule, usually with. Without money, the concept of money lending wouldn’t exist.

A residential mortgage loan officer is a licensed professional who helps consumers obtain a mortgage or other type of home financing like a heloc or hel. You can follow these four steps to become a lender: Why become an sba lender?.

Best for paypal business users: Want to learn how to become a p2p lender? What is a mortgage lender and how do they work?

How to choose a lender. Seeing how much income banks and major lenders make. To learn how to become a lender, consider these four steps:

Become an sba lender. Bonds issued by aareal bank, another german lender exposed to us commercial real estate, have also been hit, though to a lesser degree. Active investing with sofi makes it easy to start investing in stocks and etfs.

Want to become a mortgage loan officer? This form of social lending aims to make financing and. You’ll also need knowledge in that particular industry.

/four-secrects-to-making-money-58dc88323df78c516216db18.jpg)