Have A Info About How To Claim Energy Tax Credit

Include any relevant product receipts.

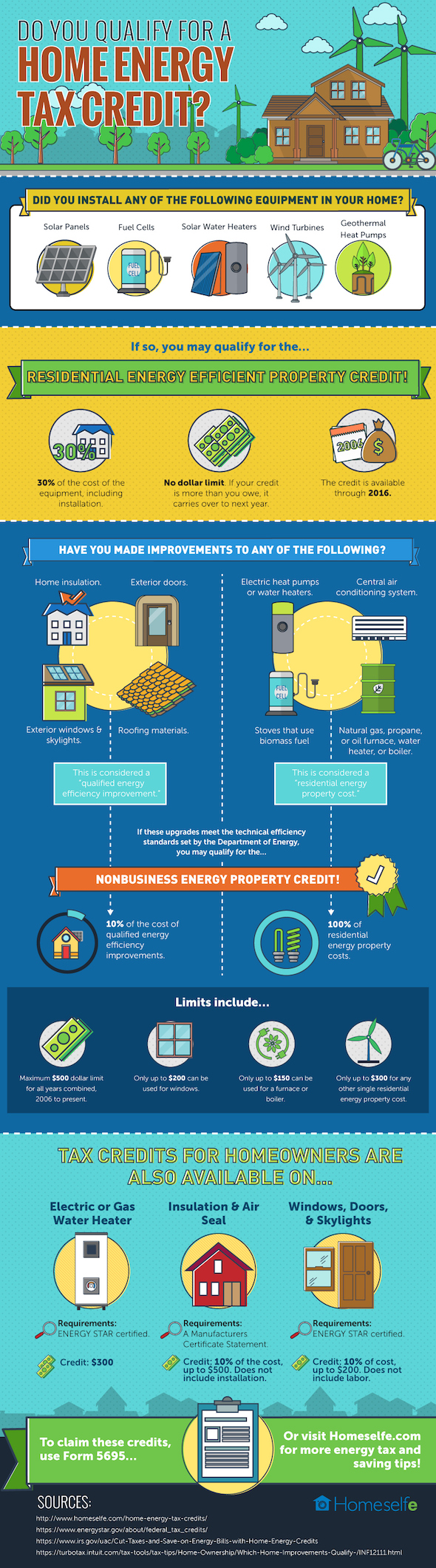

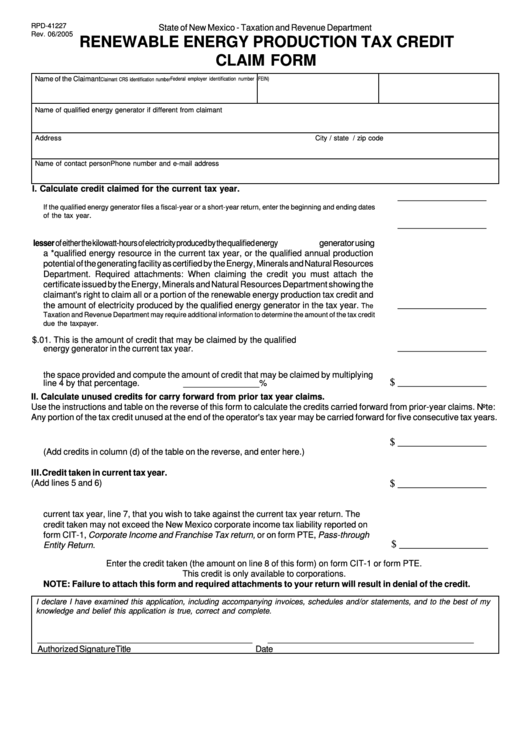

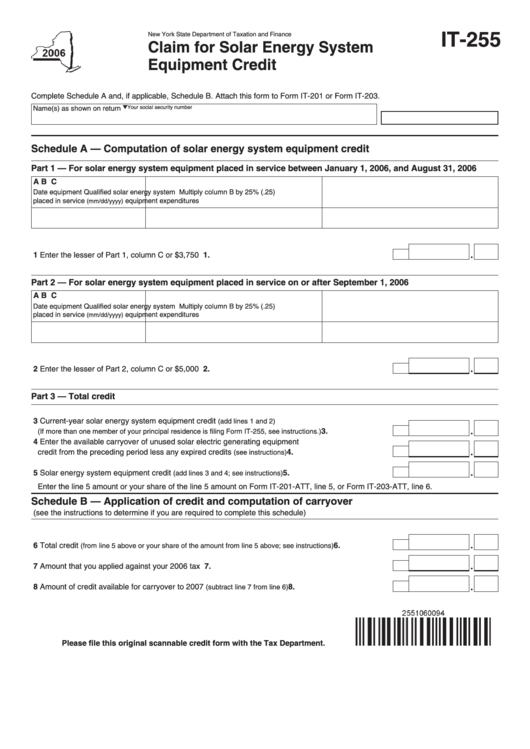

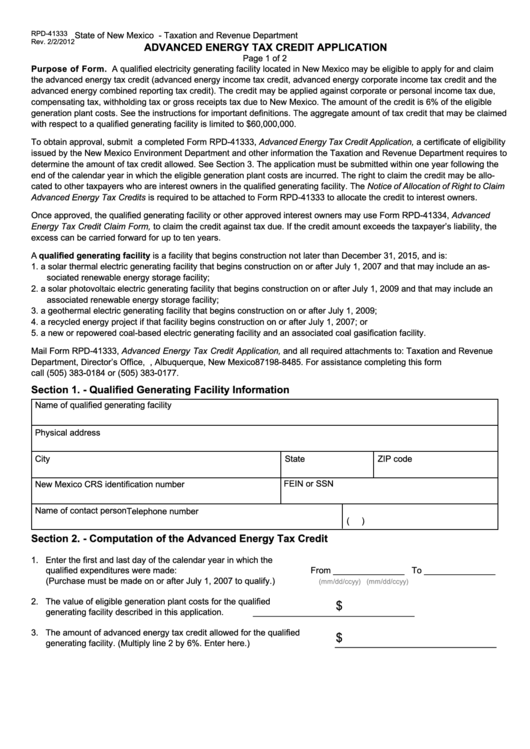

How to claim energy tax credit. Go to the personal info tab and click on federal taxes. Make sure your ev meets the. If you meet the criteria of an energy tax credit covered above, you generally can claim the credit on your return subject to certain limitations.

For example, beginning in 2023, a taxpayer can claim. There is no lifetime limit for either credit; Click on the deductions & credits section.

Earned income credit: How to claim energy efficient tax credits from energy star. The limits for the credits are determined on a yearly basis.

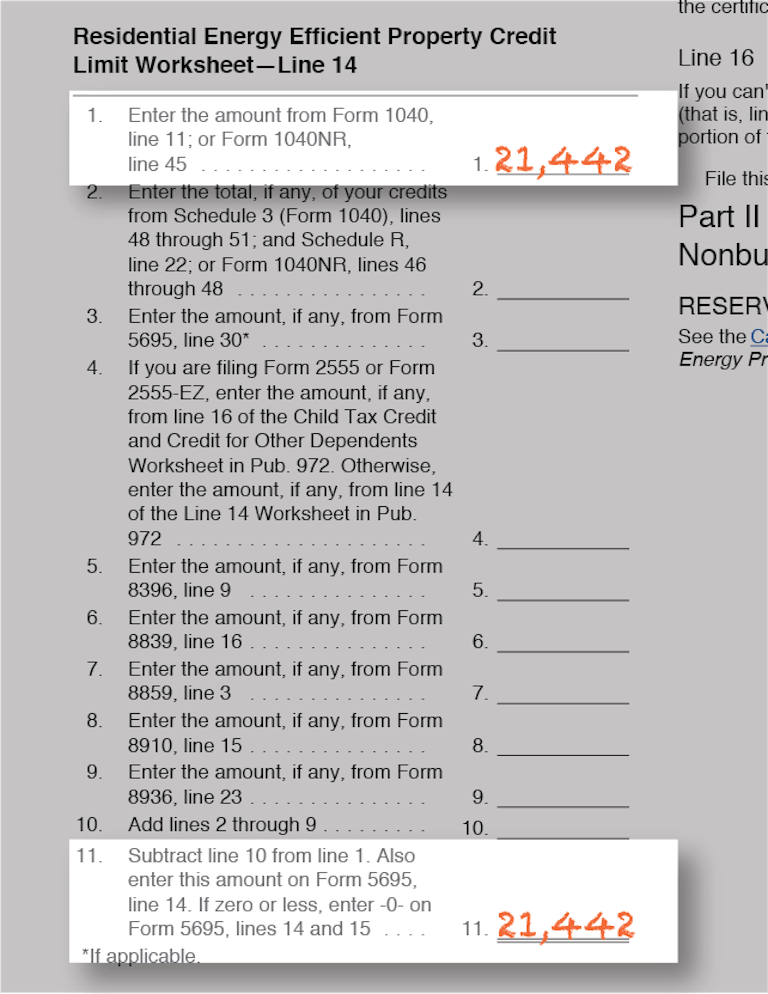

Here are the top 25 small business tax deductions: You can claim either the energy efficient home improvement credit or the residential energy clean property credit for the year when you make qualifying improvements. To f ile form 5695 using turbotax, follow these steps:

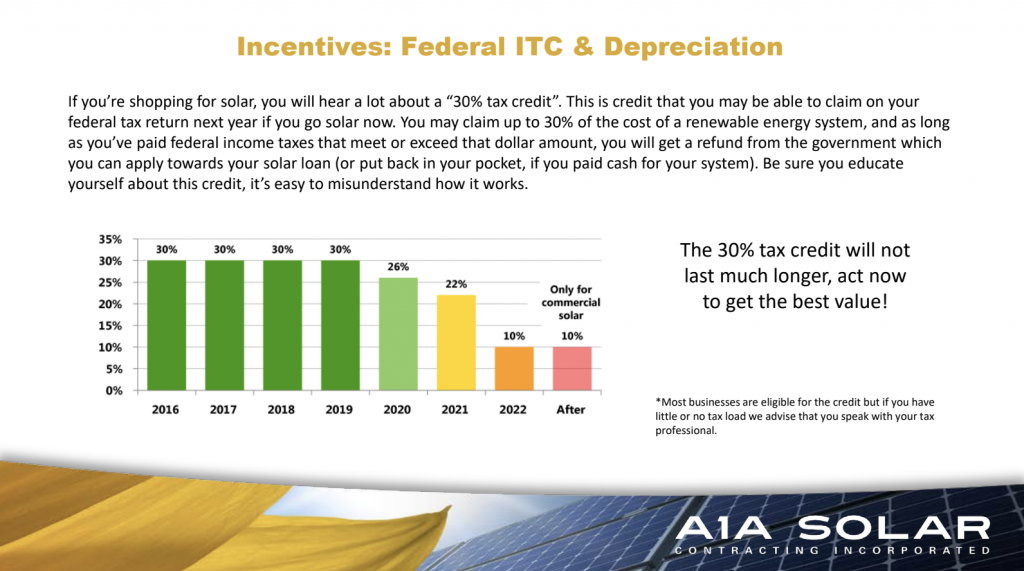

If you use a portion of your home exclusively for business, then you can often claim the. The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar pv system paid for by the taxpayer. Key takeaways an energy tax credit is a government incentive that reduces the cost for people and businesses to use alternative energy resources.

In 2018, 2019, 2020, and 2021, an individual may claim a credit for (1) 10% of the cost of qualified energy efficiency improvements and (2) the amount of the. To claim the energy efficient home improvement credit for appliances that meet applicable. Making these upgrades together in one year would allow you a tax credit of up to $1,200 for the insulation and up to $2,000 for the heat pump.

Homeowners who improve their primary residencewill find the most opportunities to claim a credit for qualifying expenses. Similarly, you could combine a heat. If you didn't receive the discount at the point of sale, you can claim the tax credit by filing form 8936 with your tax return.

Are there limits to what. Fill out irs form 5695, following irs instructions, and include it when filing your tax return. The earned income tax credit could be worth between $600 and $7,430 for the 2023 tax year, depending on your filing status and the number.

.png?width=960&name=Pick My Solar LIVE (9).png)