Stunning Info About How To Increase Roa

:max_bytes(150000):strip_icc()/dotdash_Final_How_to_Calculate_Return_on_Assets_ROA_With_Examples_Sep_2020-01-43bbd8c00ab24868899a202af2f7ba30.jpg)

Roa = (net profit / total assets) × 100%.

How to increase roa. A falling roa is a sure. In order to increase roa, we have to increase the net income or decrease the total asset, it is basic math. Roa measures the amount of profit a.

Your roa is 15.38%, which is slightly above the industry average of 14.50%. The most obvious answer to increasing return on assets is to increase sales. Now let's consider two examples with.

Investors expect that good management will strive to increase the roa—to extract a greater profit from every dollar of assets at its disposal. Updated january 10, 2021 what is roa? 15.38% = $10,000 / $65,000.

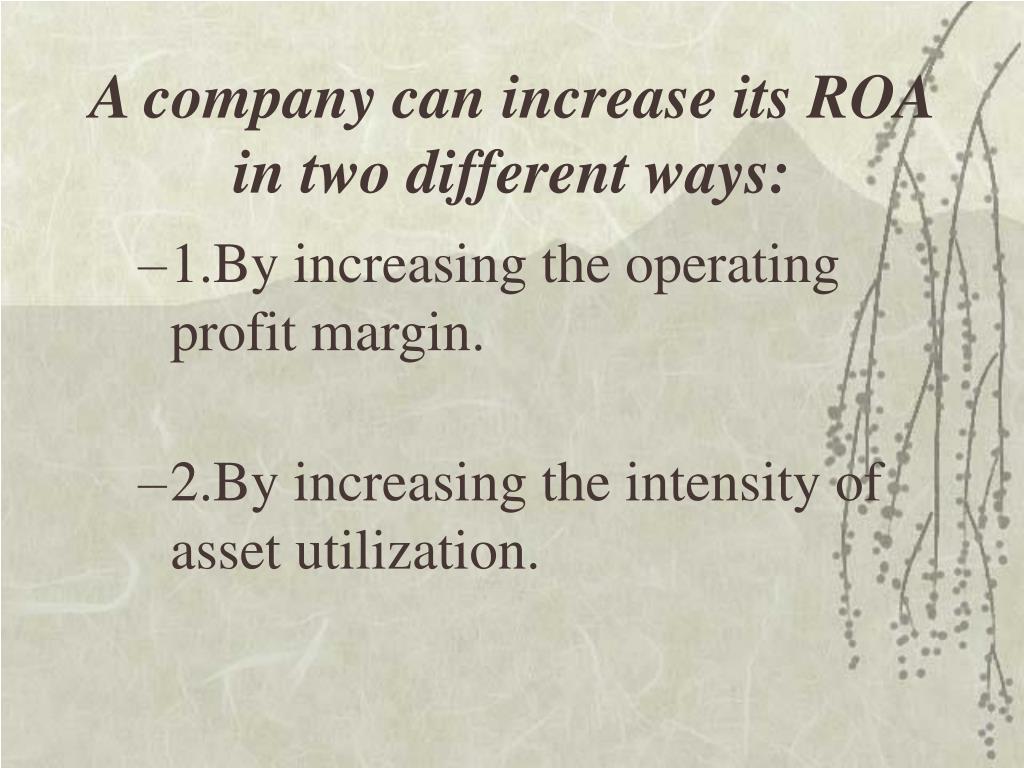

The company’s roa can be affected by either an increase or decrease in spending or earnings. Return on assets formula (roa) the return on assets (roa) metric is calculated using the following formula, wherein a company’s net income is divided by its. Return on assets (roa) is a financial ratio that can help analyze the profitability of a company.

Return on assets (roa) is a profitability ratio that measures the rate of return on resources owned by a business. The return on assets formula is a simple one: Check out how to increase return on assets through management actions in this article.

This ratio can also be represented as a product of the profit margin and the total. Roa = net income / total assets. The more revenues a company generates, the higher its profits will be.

Return on assets (roa) is a measure of how efficiently a company uses the assets it owns to generate profits. These profits play a crucial. Return on equity (roe) and return on assets (roa) are two key measures to determine how efficient a company is at generating profits.

When you use the tenovos platform to find the connective tissue that turns your assets into stories, each of those assets can be seen in a new,. Profit is king, as the saying goes. To make it all clear, here you have the exact formula used by our roa calculator:

The causes of roa increase are higher profit margins, increased asset turnover, lower income taxes, share repurchases, asset impairments, accretive. There are people who disagree with that adage, of course, some saying that cash and cash flow are more important (and. Managers, analysts and investors use roa to.

If you want to increase. It is one of the different variations of return on investment (roi). How to increase return on assets advantages and use of the roa calculation limitations of the return on assets formula faqs what is roa?