Marvelous Info About How To Write Irs

21, 2024, that the agency will.

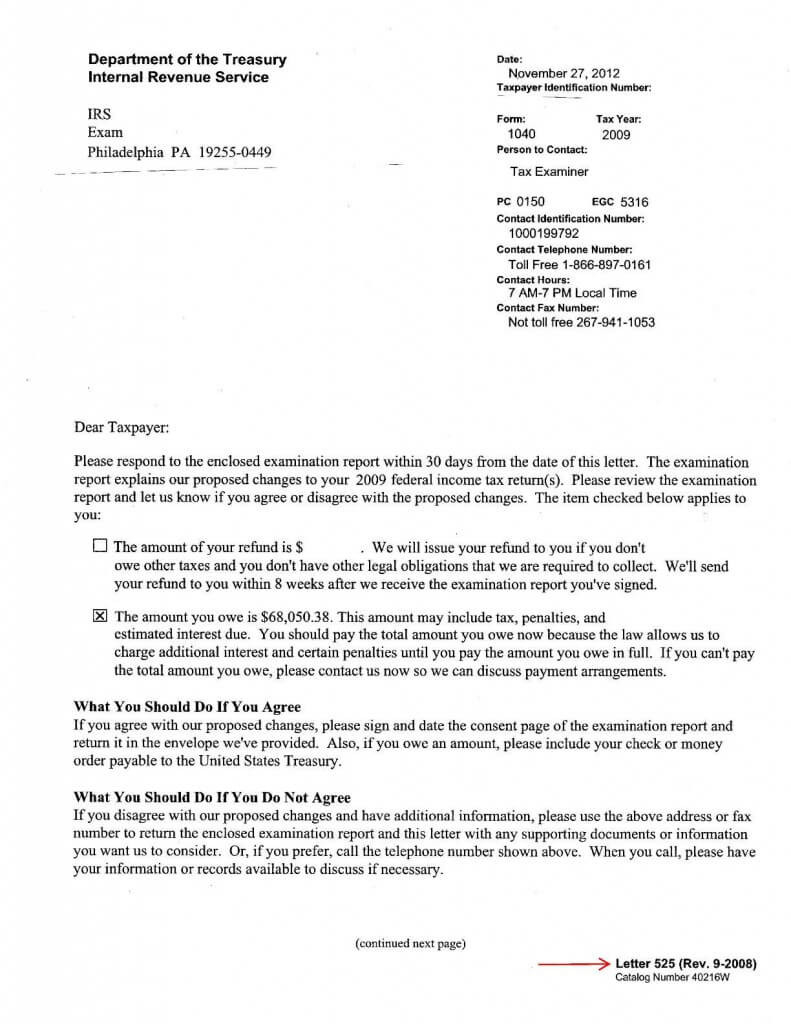

How to write to irs. Each notice deals with a specific issue and includes specific instructions on what to do. Press “2” for “answers about your personal. Explaining changes to your return or.

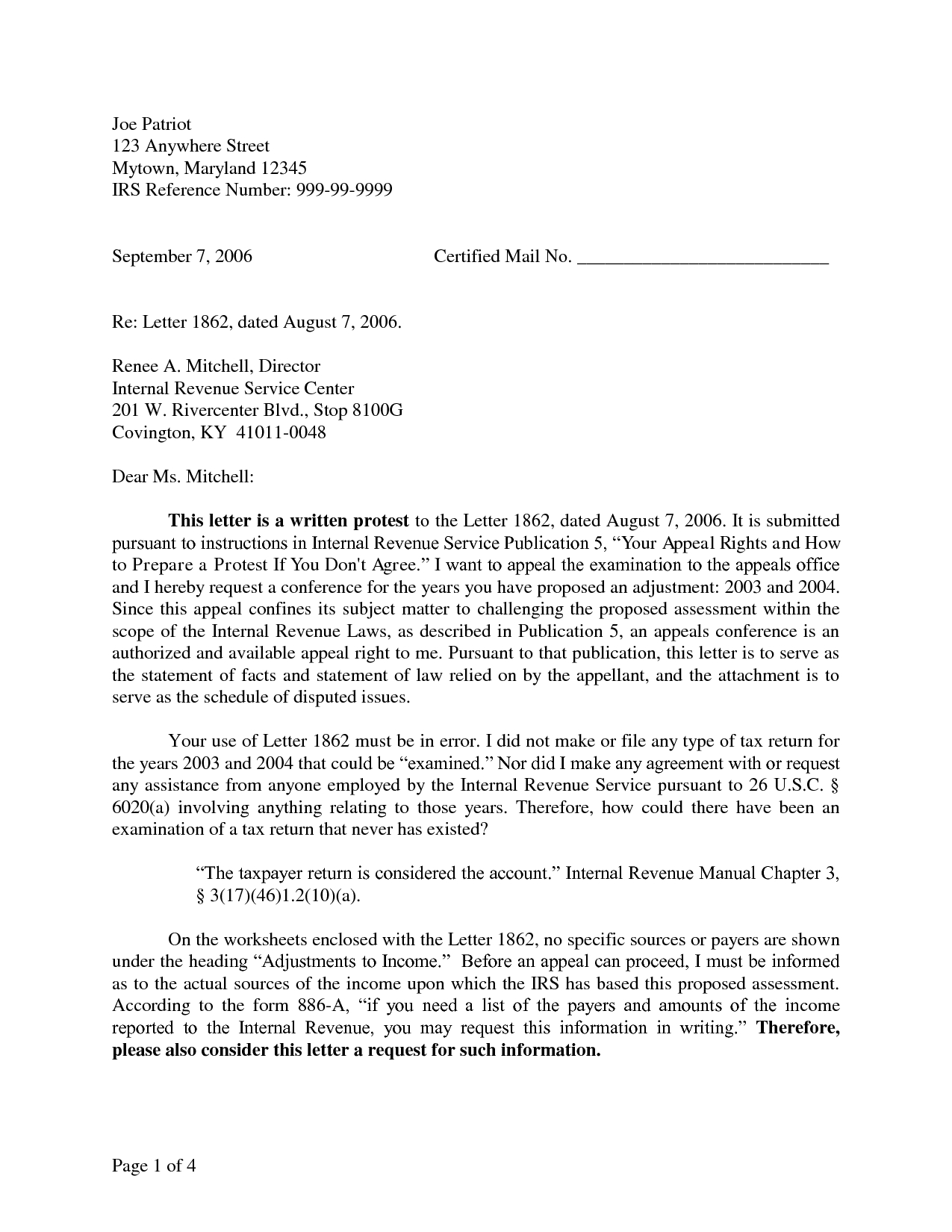

There is no magic formula for writing a letter to the irs. This isn't a letter to inform.

A specific issue on your federal tax return or account; There are many ways you can reach the irs. Write the date on the check.

Most irs letters and notices are about federal tax returns or tax accounts. The main thing you need to do is clearly explain why you are right and the irs is wrong. When writing a letter to the irs, those that are properly addressed will get routed to the correct department and get a quick response.

How to write a letter to the irs to waive penalty. When writing a letter to the irs, it is important to include your contact information at the top of the letter. The irs mails letters or notices to taxpayers for a variety of reasons including if:

Press “1” for english or “2” for spanish. They have a balance due. How to file your taxes:

If you follow this path, keep a written record. Or speak with a representative by phone or in person. Fill in the payee information.

Taxpayer’s name, address, and contact information. Clearly state the subject of. 27, 2015, in scottsdale, ariz.

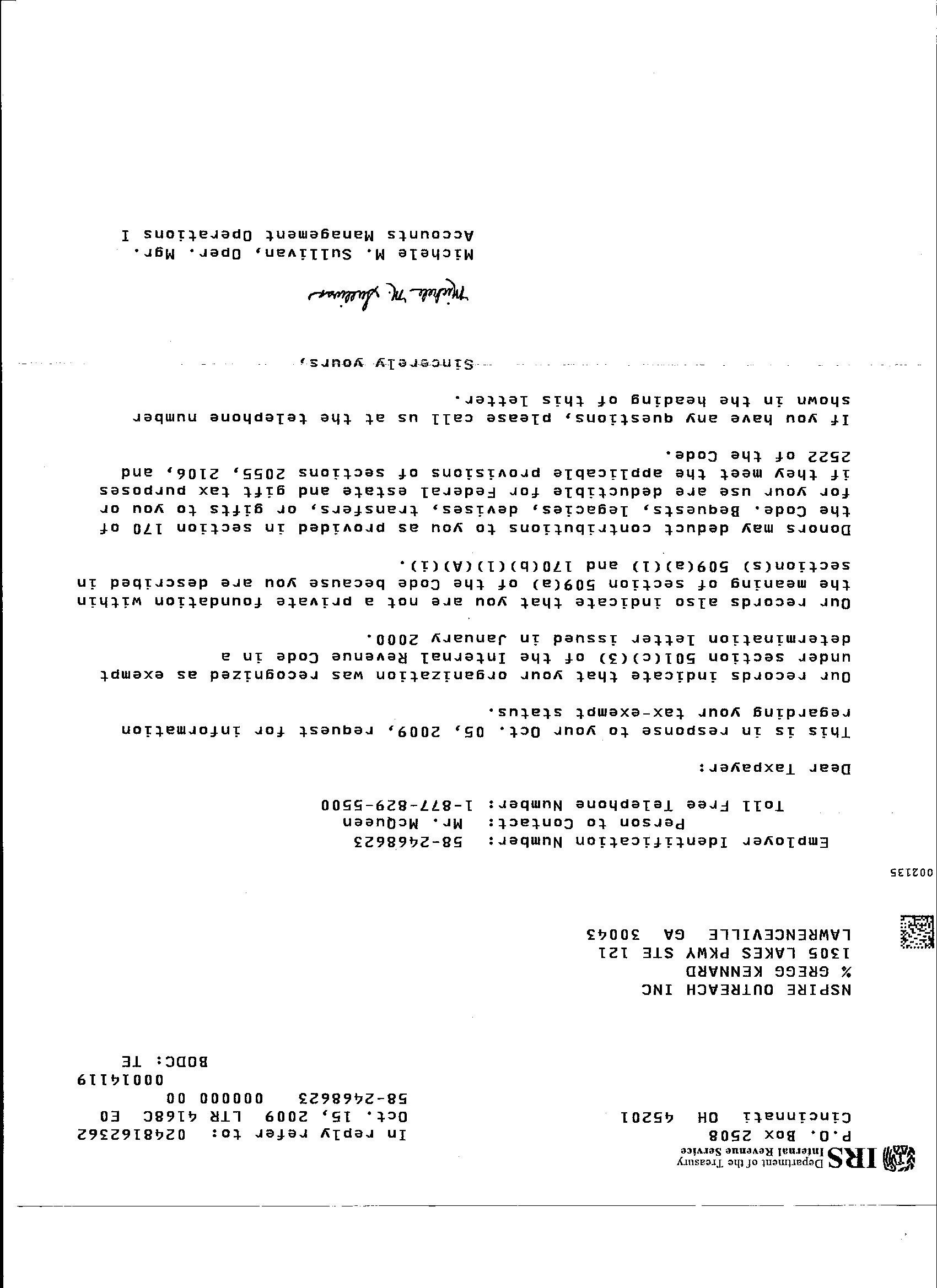

The irs will send a notice or a letter for any number of reasons, including: This helps the irs to identify and respond to your. (insert the name of the taxpayer) requests a ruling on the proper treatment of (insert the subject matter of the letter ruling request) under section (insert the number) of the.

How to contact the irs. To get a copy of your irs notice or letter in braille or large print, visit the information about the alternative media center page for more details. We can help you online, by phone or in person.