Supreme Tips About How To Claim Exemptions On W 4

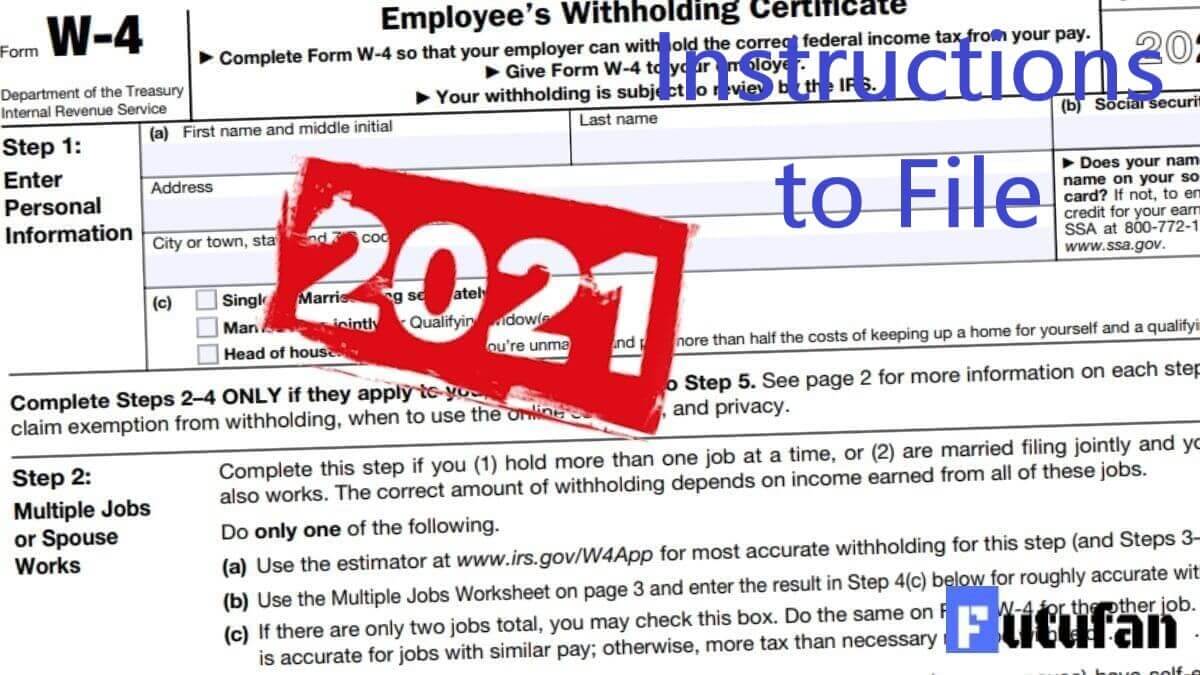

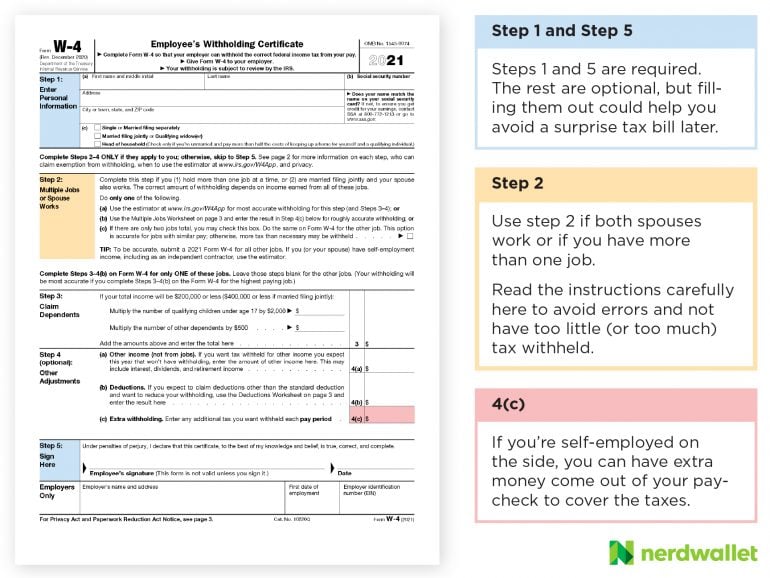

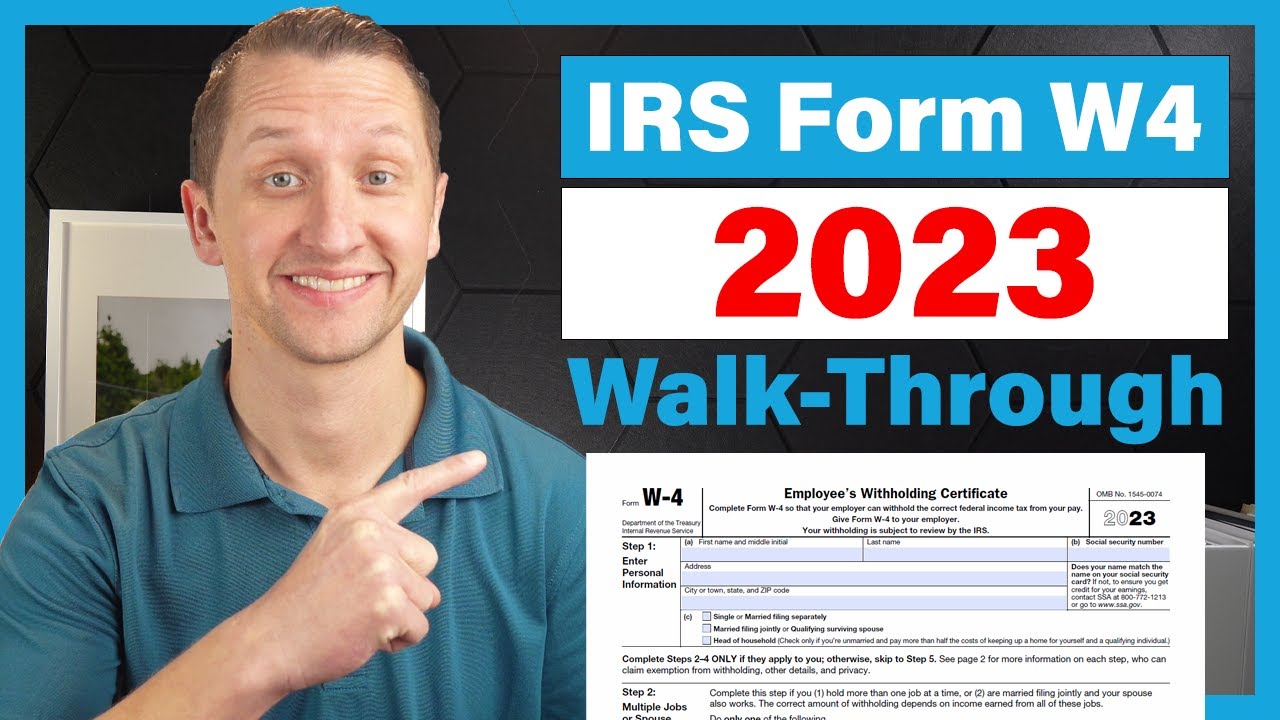

First, you’ll need to fill out step 1:

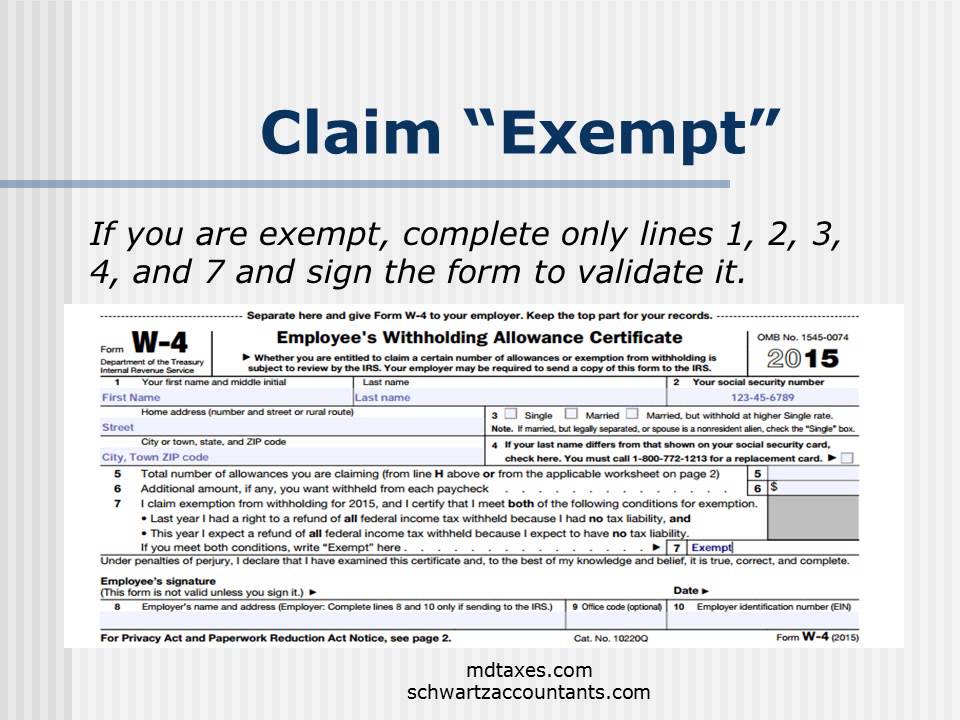

How to claim exemptions on w 4. If you qualify, you don’t need to. Employers use the information provided on a. It’s a simple calculation where you.

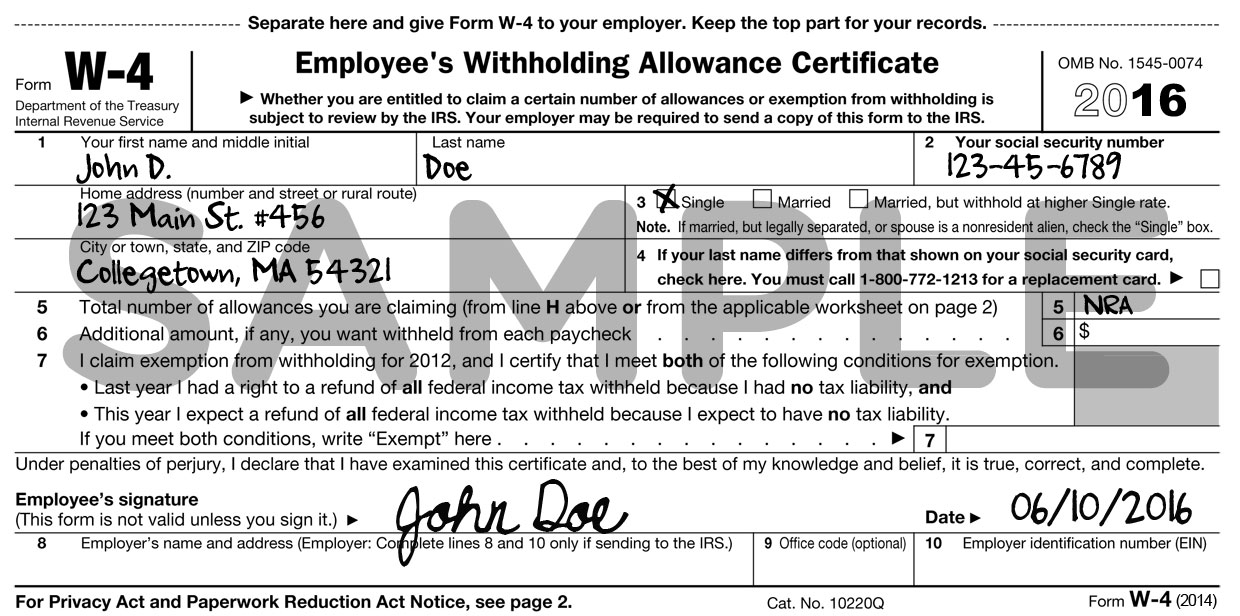

Employees who are eligible to be exempt from withholding, and those who file. Step 2 is if you have multiple jobs or your. If you want a big refund check, then do not.

You legally could refund all. In the past year, you had no tax liability; A good rule of thumb is if you want your money throughout the year, then claim your correct number of exemptions.

Complete steps 1(a), 1(b) and 5, then stop. Fill out the step 1 fields with your personal information. You fill this out if you earn $200,000 or less (or $400,000 or less for joint filers) and have dependents.

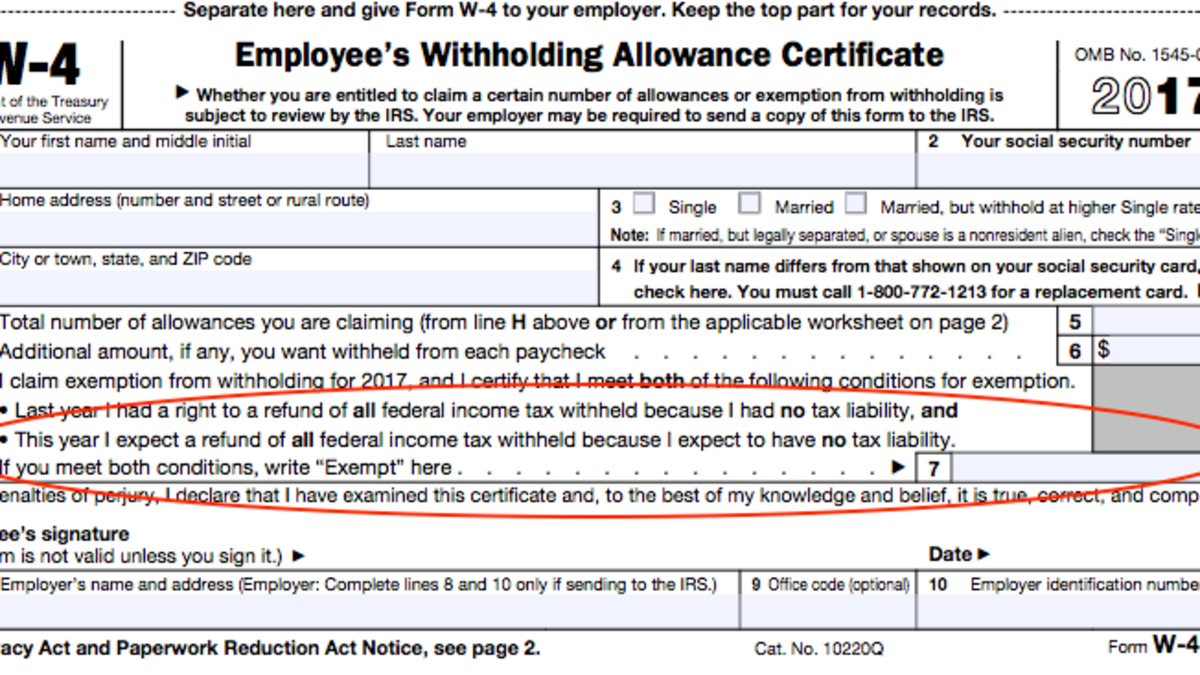

What happened to withholding allowances? Employees eligible to claim exempt from withholding will notice that the new form is different. And the number of allowances.

If too little is withheld, you will generally owe tax when you file. More specifically, taxpayers no longer claim personal or dependency exemptions, meaning, the withholding amount is no longer tied to these exemptions. Leave those steps blank for the other jobs.

Are all employees required to furnish a new.

:max_bytes(150000):strip_icc()/W4eng-b237d0a065e642b1abdba0fa653d8c1b.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2021-02-05at7.25.53PM-30d1f6f9936c4f7aa8c22c5f33269801.png)