Top Notch Info About How To Claim Your Tax Rebate

Rebate under section 87a helps taxpayers reduce.

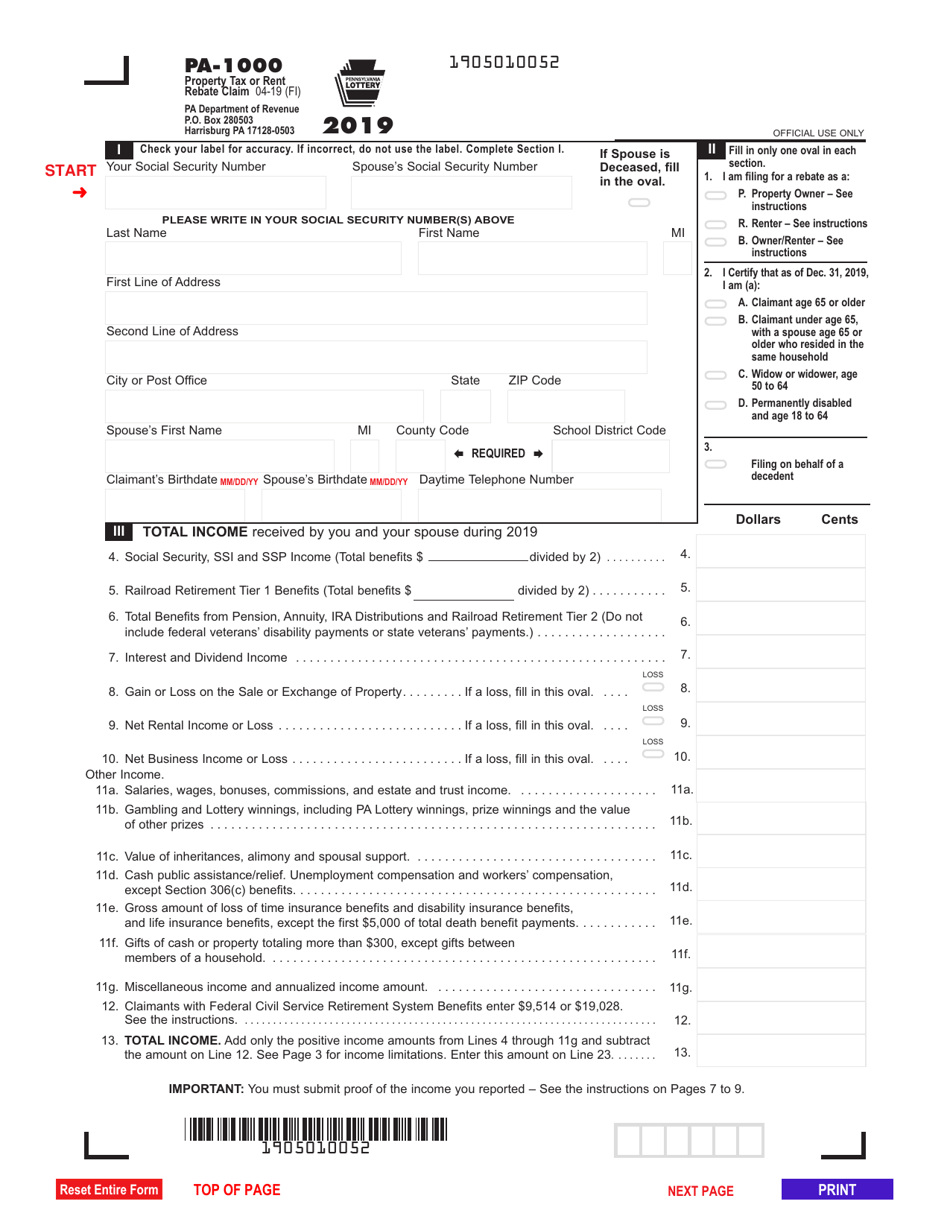

How to claim your tax rebate. Observers sometimes refer to a tax rebate as a refund of taxpayer money after a retroactive tax decrease. Who is eligible? If you didn't get the full amount of the third economic impact payment, you may be eligible to claim the 2021 recovery rebate credit and must file a 2021 tax.

Making these upgrades together in one year would allow you a tax credit of up to $1,200 for the insulation and up to $2,000 for the heat pump. To find out more about the hmrc app on gov.uk. Your 2021 recovery rebate credit will reduce any tax you owe for 2021 or be included in your tax refund.

Claim the 2021 recovery rebate credit. You may be able to get a tax refund (rebate) if you’ve paid too much tax. If your income is $73,000 or less, you can file your.

Beginning in 2033, the maximum percentage of your. How to claim a tax refund: What is a tax rebate?

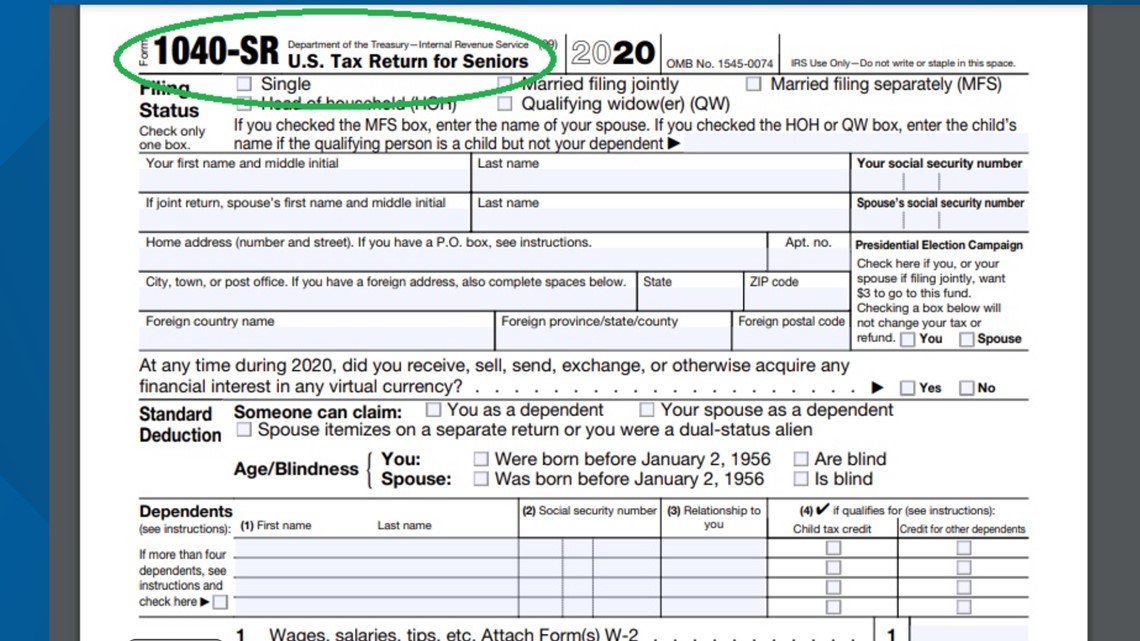

If you did not receive the full amount of eip3 before december 31, 2021, claim the 2021 recovery rebate credit (rrc) on your 2021 form 1040, u.s. The second full stimulus payment was $600 for single individuals, $1,200 for married couples and $600 per dependent. Earned income credit:

These measures are more immediate than tax. Go to the get refund status page on the irs website, enter your personal data then press submit. Similarly, you could combine a heat.

If you earned more than $99,000 ($198,000. The 2020 recovery rebate credit (rrc) is established under the cares act.if you didn’t receive the full amount of the recovery rebate credit as eips, you may be able to claim. You may have received a p800 letter informing you that you have paid too much tax, and are due a refund.

Generally, to claim the 2020 recovery rebate credit, a person must: Check how to claim a tax refund. You may be eligible to claim a 2021 recovery rebate credit on your 2021 federal tax.

Where to check if your tax code is correct and when hmrc will pay you a rebate explained you can check your tax code by using. When your third economic impact payment is scheduled, find when and how. The earned income tax credit could be worth between $600 and $7,430 for the 2023 tax year, depending on your filing status and the number.

How do i claim a tax rebate? This video looks at how you can view, manage and update details and claim a tax refund using the hmrc app. To qualify for the maximum credit, you must have your upgrades installed by 2032.